Proactive Tax Planning = Less Stress, More Savings, Smarter Growth

Proactive Tax Planning = Less Stress, More Savings, Smarter Growth

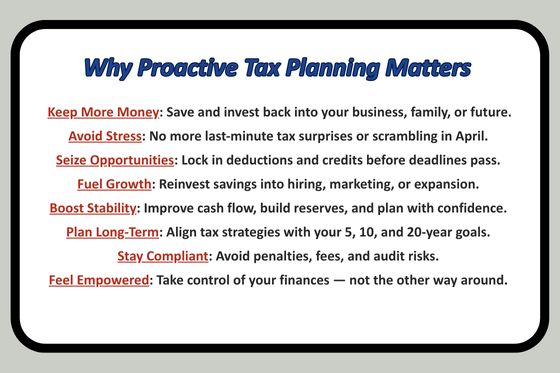

Proactive tax planning is one of the smartest financial strategies a business can invest in. Instead of waiting until tax season for surprises, it means checking your finances throughout the year, finding ways to save, and making smart decisions before it’s too late.

It’s about being intentional - using deductions, credits, and other strategies before the year ends to lower your taxes and keep more cash in your business.

How Tax Planning with OverView Bookkeeping and Consulting Supports Your Success:

- Real-Time Financial Clarity:

We don’t just close your books — we deliver accurate, up-to-date financials so you have a clear picture of your business health all year long. - Collaboration with Your Tax Professional:

We work closely with your CPA or tax advisor, providing organized, strategic financial reports that make proactive tax planning possible (and easy). - Strategic Recommendations:

When we notice opportunities for tax savings — whether it's expense adjustments, asset planning, or tax credit eligibility — we bring it to your attention early. - Education and Empowerment:

We make sure our clients understand their numbers, not just see them. This empowers you to make smarter business and tax planning decisions. - A Partner You Can Count On:

Tax planning isn’t a once-a-year event. We’re here month after month, helping you stay ahead of the game — so there are no big surprises at the end of the year.

Real time results:

We recently had a client who met proactively with their tax professional in September, using the financial information we provided.

Initially, their tax liability was quoted at $25,000. After just 45 minutes of strategic review, it dropped to $19,500. And when it came time to write the final check to the IRS — it was under $14,000!

If that’s not your experience, let's talk.

At OverView Bookkeeping and Consulting, we don’t just prepare your numbers — we help you plan your future.

At OverView, we go beyond number crunching to uncovering savings opportunities. We support your success through the year with periodic reviews where we will:

- Put on our business owner goggles and look at your books like they are our own.

- Search for cost-saving opportunities that other bookkeeping companies overlook.

- Offer input and insights on where you can save money and help you put together a list of questions to ask your CPA so you can reduce your tax bill next year.

Important: You have some control legally and ethically to reduce your tax liability, but you need to be proactive in doing so.

OverView helped me with my taxes. I owed $45K in my first year of business. OverView identified an overpayment and shared that information with my CPA. Now, my taxes are $2-3K.

JC